More than almost any other factor, postsecondary education is associated with larger earning potential, and adults with bachelor’s degrees are only about half as likely to be unemployed. A postsecondary degree is the ticket to achieving social and economic mobility, yet too few students are able to enroll in, afford, and complete college.

To address these realities, our higher education work is equity-centered and focuses on closing gaps in access and success and on making college more affordable for students, particularly those from low-income families and families of color.

Data is at the heart of what we do. We monitor constantly, identify problems, and identify institutions with problems. Essentially, we use data to inform all of our work

Access

We advocate on behalf of low-income students and students of color to ensure they have equitable access to high-quality postsecondary opportunities.

Affordability and Financial Aid

We work to improve federal, state, and institutional financial aid policies to better serve students with the most financial need.

Completion and Success

We focus on improving student success, particularly for low-income students and students of color.

Ending Student Hunger & Homelessness

Hunger and homelessness were serious issues prior to the pandemic, and COVID-19 has only made them worse. Disparities in access to food still exist along racial lines, with 18% of Black households and 16% of Latino households, as opposed to 10% of all households, reporting food insufficiency during early summer 2021.

The Education Trust is committed to making sure that every student, especially those who are already hardest hit by COVID-19, have their most basic needs met.

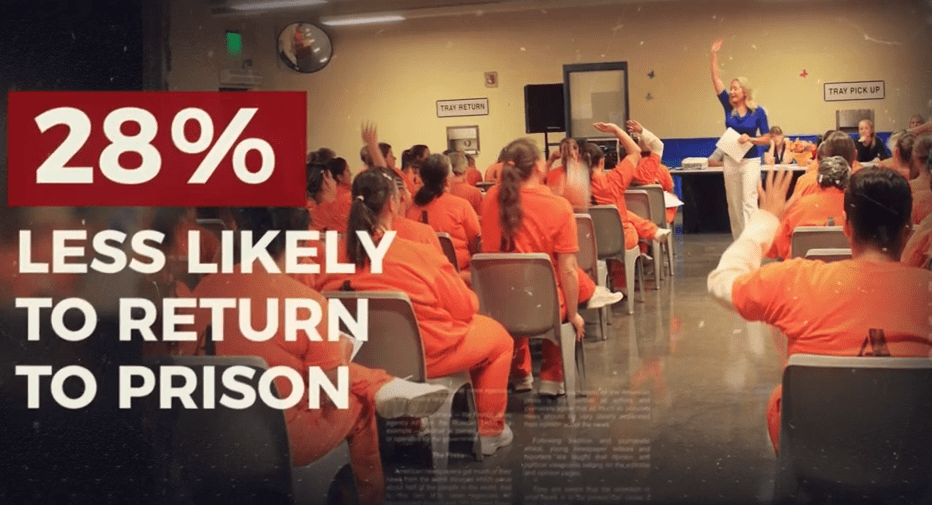

Lift the Ban on Pell Grants for Students Who Are Incarcerated

The Education Trust is committed to expanding high-quality educational opportunities to individuals who are incarcerated and otherwise impacted by the criminal justice system. Our work centers around advocating for Congress to lift the harmful ban on access to the Pell Grant for students in prison, which has been in place since the disastrous 1994 Crime Bill became law.

Reauthorization of the Higher Education Act

The original Higher Education Act (HEA) was adopted in 1965 to expand opportunity, so that no student would be denied a chance to participate in higher education due to financial limitations or socioeconomic status. Since then, the U.S. has made substantial progress in expanding college access. College-going rates are rising for students at all income levels and for every major racial and ethnic group.

As Congress works to reauthorize this important civil rights law, they must push all institutions to effectively serve students from low-income families and students of color.